Myriad is flexible and agile. It evolves with your business, supporting growth and creating opportunities to expand your service offering. With data centrally held by Myriad, enhancements can be integrated quickly and efficiently.

Myriad;

Wealth Management Software

Manage customers, advise, trade, invest and execute – through one platform.

Many parts, a single solution

Myriad is our tailored suite of financial software that provides a fully automated, highly scalable, end-to-end solution for wealth management. Built on open database architecture, Myriad offers a high level of flexibility and an extensive breadth and depth of functionality, integrating seamlessly with your existing workflow and infrastructure.

Scale your business

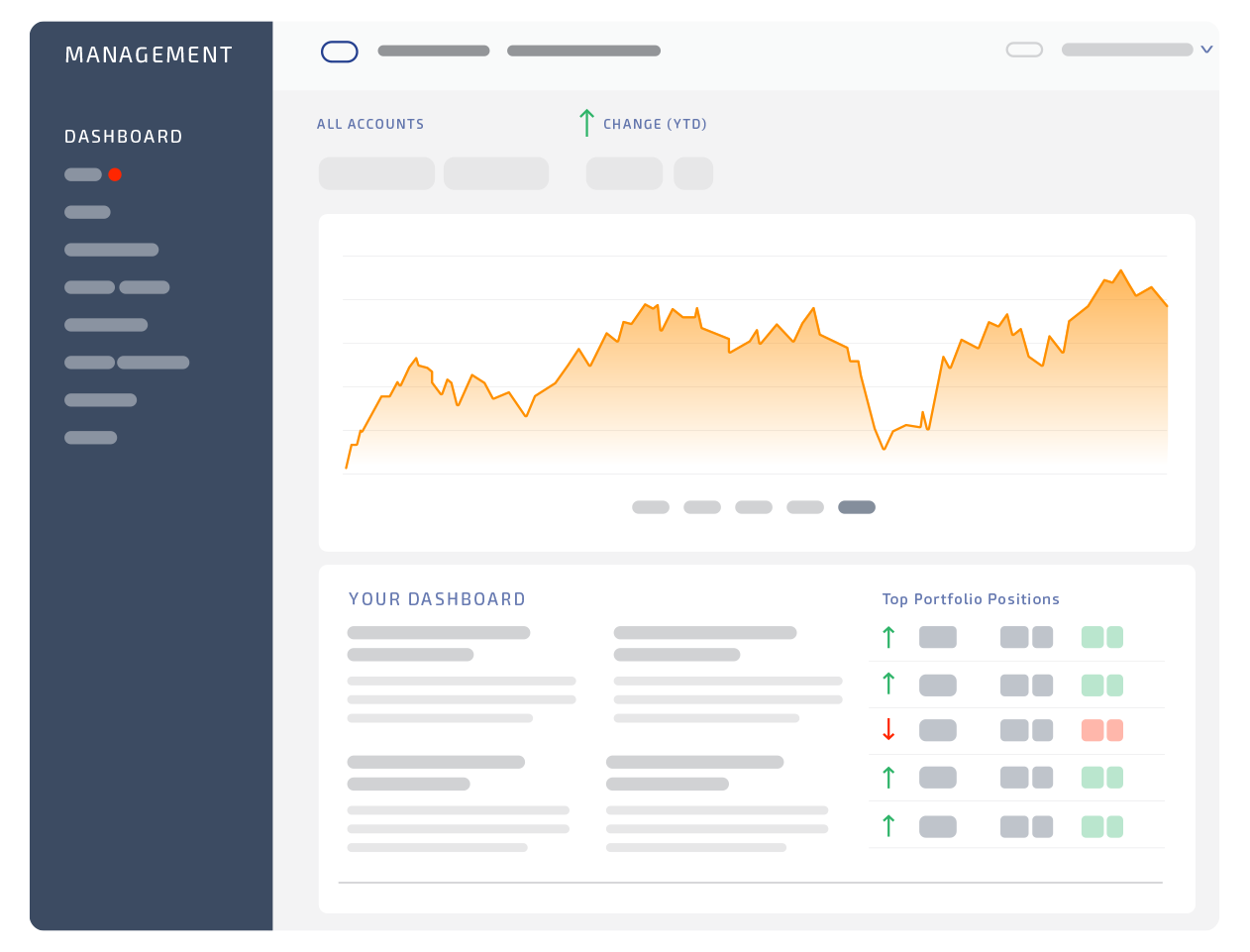

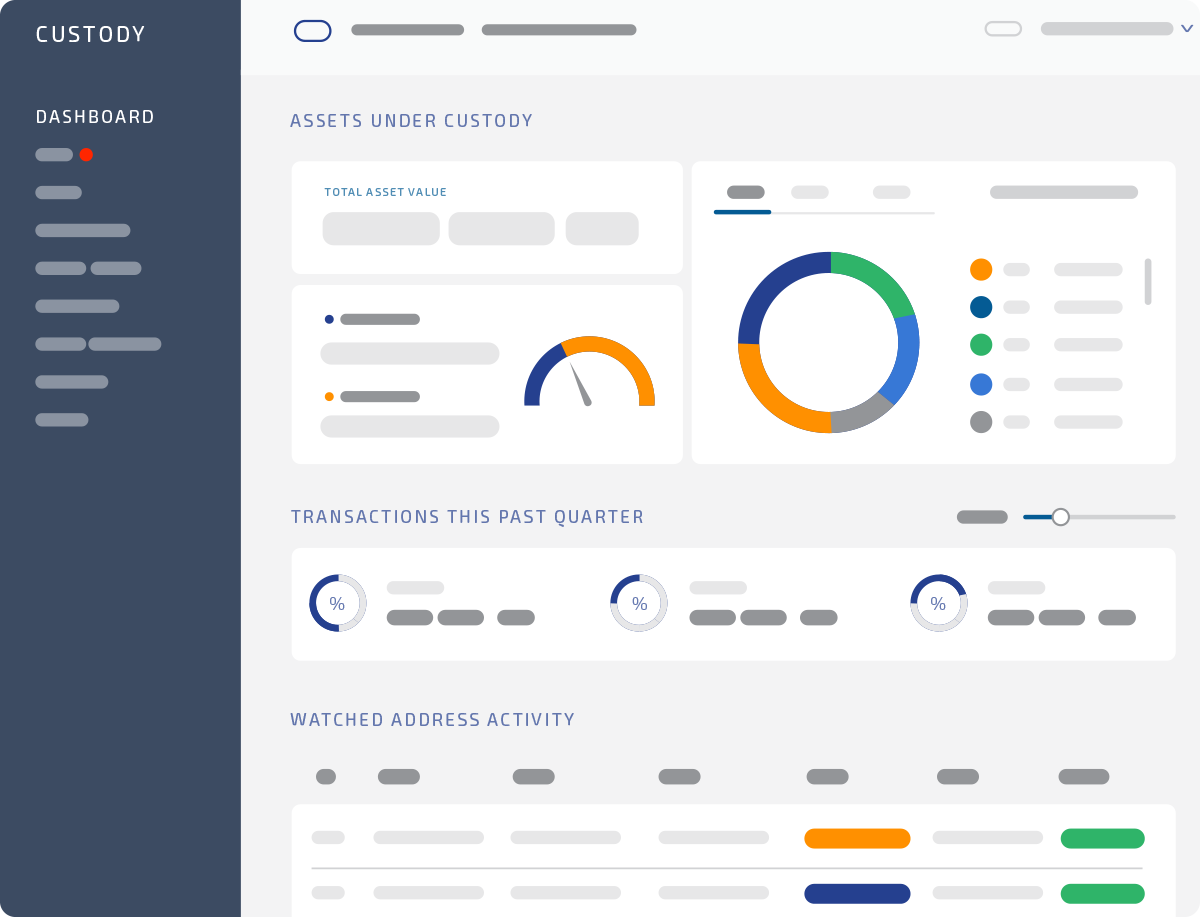

Personalised user experiences

Whether you are an adviser, broker, manager or lender, Myriad can be tailored to perform the unique functions of your role. With highly customisable interfaces, users will only see data and information relevant to them.

Prepare for the future

We look at future requirements and proactively keep you ahead of the technology curve by identifying where you can excel and improve. Our innovative approach allows for software longevity through continual R&D. New features and enhancements can be easily integrated.

Reduce technology risk

Address critical issues such as disparate or obsolete systems, degraded customer experience and lost market opportunities. Reduce costs and the technical reputation risk associated with using technologies from various suppliers.

Leverage existing systems

Use Myriad to bridge or leverage the functionality and extend the life of existing software, providing a path for the replacement of legacy systems.

Streamline operations

Remove duplication and transform disparate, disconnected systems into a single source of truth. Aggregate data and functional areas by automating and optimising core processes to create operational efficiencies.

Aggregate data from everywhere

Aggregate data across legacy and third-party systems into a single client view. Manage portfolios across platforms, leveraging your existing technology, with a single client view.

Reporting

Myriad offers sophisticated reporting solutions. Performance, contribution and attribution reporting is provided through either a full digital experience or automated reporting in multiple formats. Create sub reports, reports and report packs using industry standards. , Report packs can be assigned to clients or portfolios and individually tailored for brand, currency, frequency to provide a highly customised, automated, reporting system. Report on data aggregated across multiple platforms.

Myriad supports the

full business lifecycle

Myriad supports the

full business lifecycle

Onboard

Onboard clients and complete compliance checks.

Originate

Capture client instructions, originate orders, rebalance and create transactions.

Transact

Execute orders, trade, settle money and register or transfer assets.

Aggregate

Aggregate transactions into any view, including account, portfolio, customer, family office, and asset registry.

Reconcile

Daily validation of asset and cash positions.

Adjust

Capture and process events, and create transactions to adjust holdings including share splits or dividends.

Report

Sophisticated digital reporting solutions to engage clients in their wealth creation.

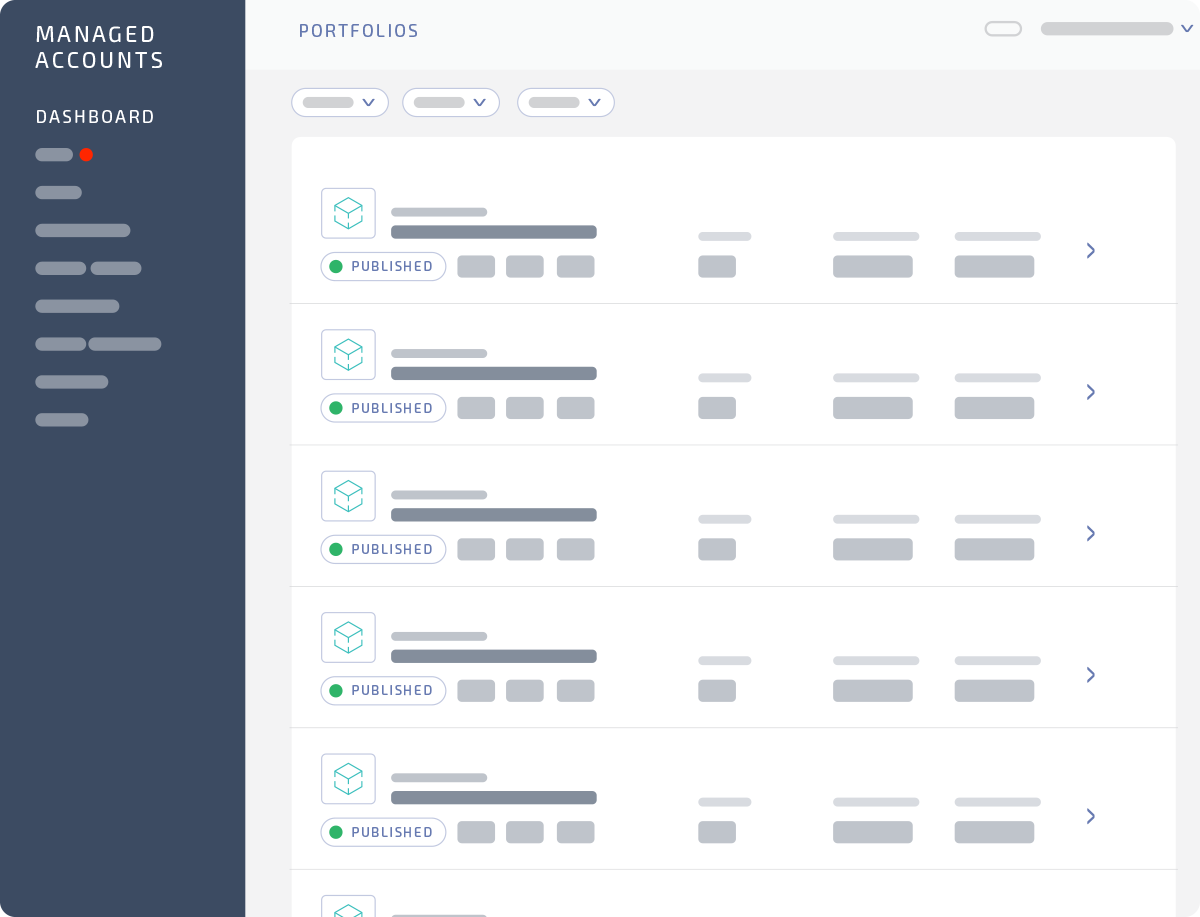

Modular technology for enhanced operational efficiency & flexibility

Myriad’s highly customisable modules provide more relevant features than any other wealth management software. With an extensive breadth and depth of functionality, Myriad’s modules offer a high level of flexibility based on workflow, with task centric, fully automated, highly scalable, single client view, end-to-end solutions that support a range of financial institutions.

Build your own experience

Our innovative UI approach offers personalisation at scale. You choose how you want to operate and only pay for what you use. Our expert team will custom-configure Myriad to deliver a tailored wealth management solution for your business, with customised interfaces for users to perform the unique functions of their role. Myriad provides a seamless workflow tool and highly relevant, simplified view of information and activity.

Personalisation at scale

Custom-configuration of your Myriad platform

Customised interfaces for users

Spend more time on wealth creation and leave the rest to us. Create operational efficiencies through a single, streamline solution with Myriad.

Years

developing and enhancing

wealth management software

USD

Billion

of investor assets managed

through Myriad

USD

Million

transacted by our

clients per day

Progressive partnerships, evolving solutions

Discover what’s possible when you partner with wealth technology innovators. Our approach is long-term and strategically-led. We focus on developing progressive partnerships and invest in ongoing software development.