Manage target asset models at any level and model structure through automation of models and mandates. Apply personalised client preferences. Asset allocation can be delivered at scale.

MANAGED & DISCRETIONARY ACCOUNTS

Robust Financial Software for Managed and Discretionary Accounts

Myriad has the full business lifecycle covered, from customer management, target asset allocation, order execution and transaction settlement, to portfolio aggregation and reporting.

Provide added value and better customer service

Efficiently manage client asset allocations

Create greater visibility

Create views for investors, advisers and asset managers with specific investment models provided to adviser groups.

Tailored portfolio management

Customise our robust platform to streamline discretionary managed account strategies and manage portfolios and asset allocation targets.

Manage client asset preferences at scale with Myriad’s enhanced functionality

Myriad offers a complete front to back office solution for Managed and Discretionary Accounts. Whether you’re investment advisory, wealth management or brokerage firms providing online security trading services, Myriad can be tailored to suit your specific needs.

Customer management

Host important customer information, onboard clients, originate orders and rebalance portfolios. Track portfolio positions and performance and originate orders for advisory and discretionary services.

Portfolio management

Get real-time decision-making support, rebalance capabilities against customisable asset allocation targets and reporting facilities in a multi-asset, multi-currency environment.

Asset record management

A single source solution for the management of all tradable instruments and assets. Access a datastore for managing issuers, assets, products and market listings.

Order management and execution

Manage order creation and aggregation, trade-desk, order routing, and FIX connectivity functionality. Automate and reconcile transactions and pass to settlements, and manage to external markets and destinations.

Custody, accounting and wrap services

Automate custodial and wrap services for institutional and retail business models, with multi-currency and multi-instrument settlement.

Equity and fixed interest market settlement

An automated, real-time, straight-through-processing solution providing a general ledger and accounting system with client funds account (trust) incorporated into the banking, and an interface with SWIFT or proprietary market settlement and clearing house regimes to provide market side stock and cash settlement.

Compliance

Access extensive pre and post trade rules, validation and business process flows in real time.

Asset record management

A single source solution for the management of all tradable instruments and assets. Access a datastore for managing issuers, assets, products and market listings.

Asset and holding valuation and analysis

Analyse performance, contribution, attribution and tax, track costs, returns and value by numerous industry standards, in multiple formats and currencies.

Margin and securitised lending

Leverage the market value of securitised assets with customer loans in any currency. Coverage includes margin lending, collateral management and margin management, together with comprehensive reporting and exposure management.

Brokerage and commissions charges

Account for and report on brokerage, spread and commission calculations and reporting on transactions and recurring fee income on portfolios.

Registry and registry reconciliation

Manage your own asset registry or provide external registry reconciliation. Reconcile one-to-one, to omnibus, to pooled holdings on trade or settled dated basis for any asset.

Corporate Action (CA) processing

Interface to CA announcement providers or manually enter CA headings where a provider doesn’t exist. Track entitlement positions and workflow for voluntary actions, generate holding adjustment transactions while tracking tax obligations.

Portfolio, performance and tax reporting

Track costs, returns and value by numerous industry standards in any currency, view portfolio activity and profit/loss with the ability to cross order flow or run a dark pool. Performance, contribution and attribution reporting can be tailored in multiple formats.

Cash management

Provide customer omnibus account facilities and products in any currency. Automate banking and cash account reconciliation, and a centralised cash settlement pool for customers trading disparate products on different platforms.

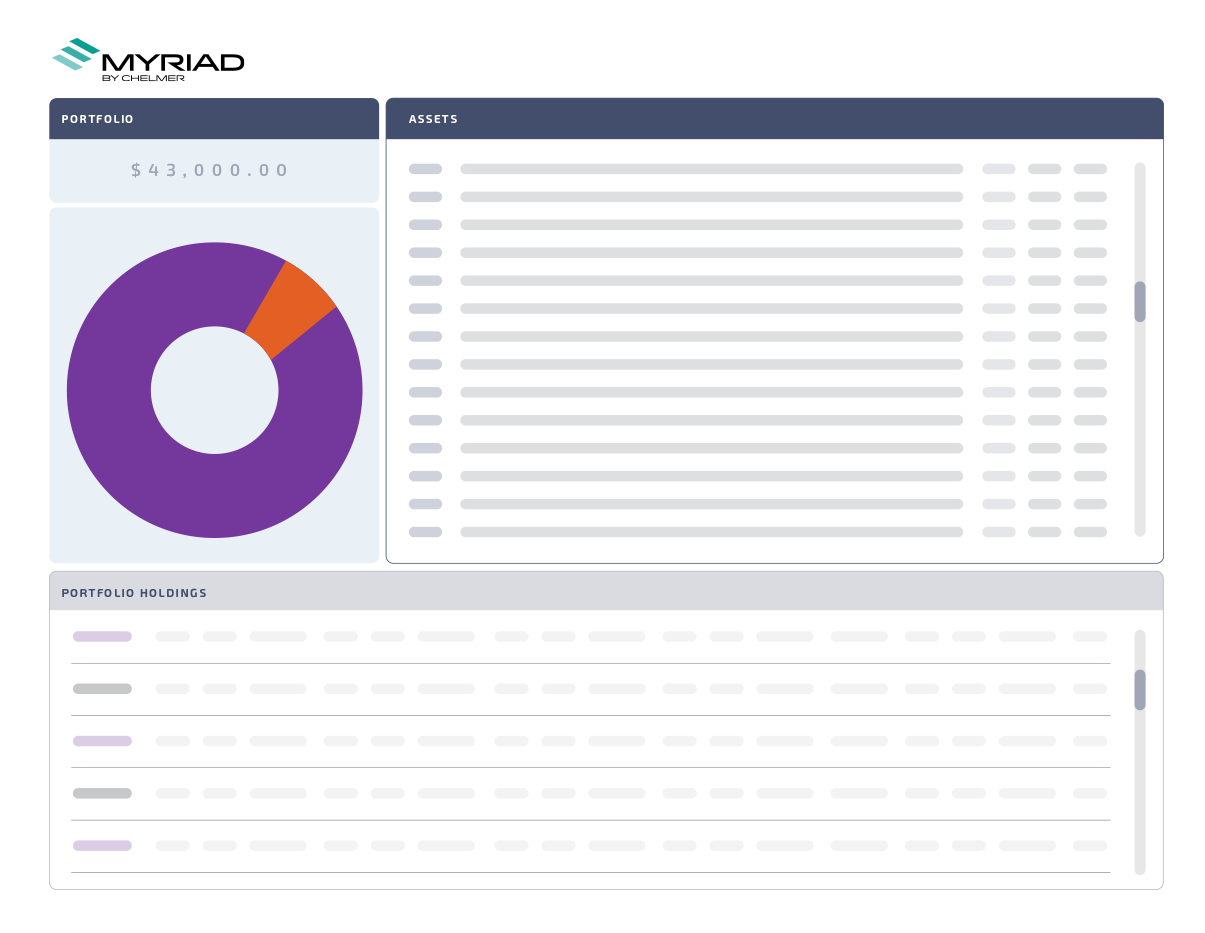

Investor Portal

Engage customers in their wealth creation, with a highly customisable, multi-view dashboard of all customer and investment information for portfolio and tax reporting to create efficiencies with one seamless workflow.

- Host all necessary customer information, including investments, personal details, documents, custody reports and other advice stipulated by regulatory authorities.

- Customers can view transactions, generate customised reports and monitor their investment portfolios in real time.

- Personalise the front-end view with your own brand and integrate into your corporate website to allow customers to view their account.